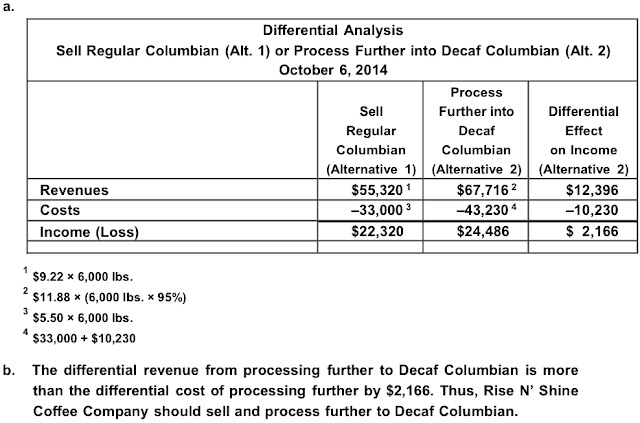

a. Prepare a differential analysis dated October 6, 2014, on whether to sell regular Columbian (Alternative 1) or process further into Decaf Columbian (Alternative 2).

b. Should Rise N’ Shine sell Columbian coffee or process further and sell Decaf Columbian?

c. Determine the price of Decaf Columbian that would cause neither an advantage nor a disadvantage for processing further and selling Decaf Columbian.

Answer:

a. Differential Analysis

Sell Regular Columbian (Alt. 1) or Process Further into Decaf Columbian (Alt. 2)

October 6, 2014

Sell

Regular

Columbian

(Alternative 1)

Process

Further into

Decaf

Columbian

(Alternative 2)

Revenues $55,320 1

$

67,716 2

C

osts –33,000 3

–

43,230 4

I

ncome (Loss) $22,320 $24,486 $ 2,166

$9.22 × 6,000 lbs.

$11.88 × (6,000 lbs. × 95%)

$5.50 × 6,000 lbs.

$33,000 + $10,230

b. The differential revenue from processing further to Decaf Columbian is more

than the differential cost of processing further by $2,166. Thus, Rise N’ Shine

Coffee Company should sell and process further to Decaf Columbian.

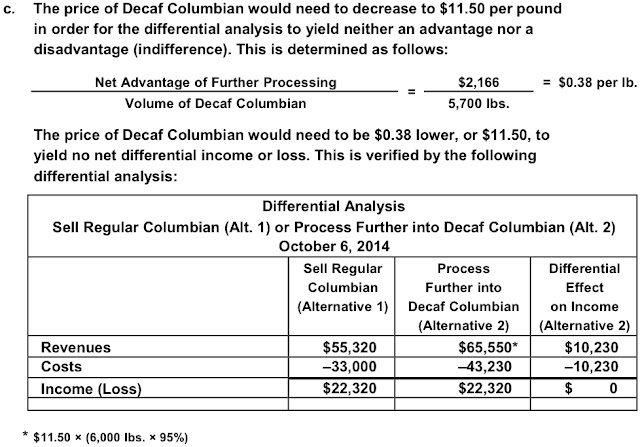

c. The price of Decaf Columbian would need to decrease to $11.50 per pound

in order for the differential analysis to yield neither an advantage nor a

disadvantage (indifference). This is determined as follows:

Net Advantage of Further Processing

Volume of Decaf Columbian

$2,166 = $0.38 per lb.

=

5,700 lbs.

The price of Decaf Columbian would need to be $0.38 lower, or $11.50, to

yield no net differential income or loss. This is verified by the following

differential analysis:

Differential Analysis

Sell Regular Columbian (Alt. 1) or Process Further into Decaf Columbian (Alt. 2)

October 6, 2014

Sell Regular

Columbian

(Alternative 1)

Process

Further into

Decaf Columbian

(Alternative 2)

Differential

Effect

on Income

(Alternative 2)

Revenues $55,320 $65,550* $10,230

Costs –33,000 –43,230 –10,230

Income (Loss) $22,320 $22,320 $ 0

* $11.50 × (6,000 lbs. × 95%)

No comments:

Post a Comment