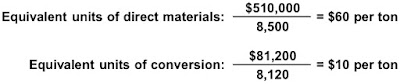

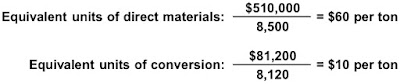

The cost of materials transferred into the Rolling Department of Keystone Steel Company is $510,000 from the Casting Department. The conversion cost for the period in the Rolling Department is $81,200 ($54,700 factory overhead applied and $26,500 direct labor). The total cost transferred to Finished Goods for the period was $553,200. The Rolling Department had a beginning inventory of $25,000.

a. Journalize (1) the cost of transferred-in materials, (2) conversion costs, and (3) the costs transferred out to Finished Goods.

b. Determine the balance of Work in Process—Rolling at the end of the period.

Answer:

a.

Work in Process—Rolling 81,200

Factory Overhead—Rolling 54,700

Wages Payable 26,500

Finished Goods 553,200

Work in Process—Rolling 553,200

b. $63,000 ($25,000 + $510,000 + $81,200 – $553,200)